Blog

MHK LOL (Loads of Logistics)

July 2024 Logistics Trends

As the U.S. trucking industry enters July 2024, it faces a complex landscape shaped by economic factors, seasonal demands, and ongoing industry transformations. With household goods season in full swing and harvest activities ramping up, shippers and carriers alike must navigate capacity challenges and fluctuating rates across various sectors of the freight market.

Impact of High Gas Prices on Trucking Costs

High fuel prices have significantly impacted the trucking industry, driving up operational costs and creating ripple effects throughout the supply chain. With diesel prices increasing over 70% in the past year, truckers are now spending upwards of $1,500 daily to fill their tanks. This surge in fuel costs has pushed per-mile trucking expenses to record highs, with the American Transportation Research Institute reporting a 35.4% year-over-year increase in fuel costs for fleets in 2021. To offset these expenses, carriers have implemented fuel surcharges and increased freight rates, leading to higher transportation costs for shippers. The rising operational costs have particularly affected small to mid-sized fleets and independent truckers, forcing some out of business and reducing overall industry capacity. As a result, consumers are experiencing higher prices for goods due to the increased cost of transportation, highlighting the far-reaching impact of fuel prices on the entire logistics ecosystem.

Impact on Freight Rates

Freight rates in 2024 are showing signs of recovery after a period of stagnation, with positive indicators emerging in the logistics industry. The Logistics Managers’ Index (LMI) saw a significant increase to 55.6 in January, signaling growth in the sector. This upturn is supported by a surge in freight activity as retailers begin to rebuild inventories, boosting demand for transportation services. Transportation prices have also risen for the first time since June 2022, indicating a potential market shift. While volatility is expected to continue due to economic uncertainties and geopolitical tensions, the industry is likely to see ongoing integration of technology-driven solutions to enhance rate management and forecasting accuracy. Additionally, environmental sustainability is becoming an increasingly important factor in freight rate dynamics, with stakeholders prioritizing eco-friendly initiatives. These trends suggest a more robust and resilient transportation and logistics industry moving forward, potentially easing financial pressures on carriers and brokers.

Key Cargo Trends

The freight market appears to be transitioning from a deflationary to an inflationary environment in 2024, with rates expected to continue climbing, especially in the latter half of the year. However, the increases are not expected to reach the extreme levels seen during the pandemic. Shippers are advised to closely monitor market conditions and potentially lock in contract rates before further increases occur.

Dry Van Rates:

As of May 2024, the average spot rate for a dry van was $2.02 per mile, or $2.44 per mile as a contract rate .

Dry van rates have been trending upward in 2024 after declining in 2023. The Coyote Curve index measuring year-over-year change in spot rates has been climbing for four straight quarters .

Reefer (Refrigerated) Rates:

As of May 2024, reefer freight rates were averaging $2.40 per mile, $0.07 lower than in April .

Reefer rates are highest in the West, averaging $2.47 per mile. The lowest rates are in the Northeast, with an average of $1.90 per mile .

Flatbed Rates:

As of May 2024, the average spot rate for a flatbed truck was $2.53 per mile, or $3.13 per mile as a contract rate .

National average flatbed rates were $2.53 per mile in May, $0.01 higher than the April average .

Ocean Container Rates:

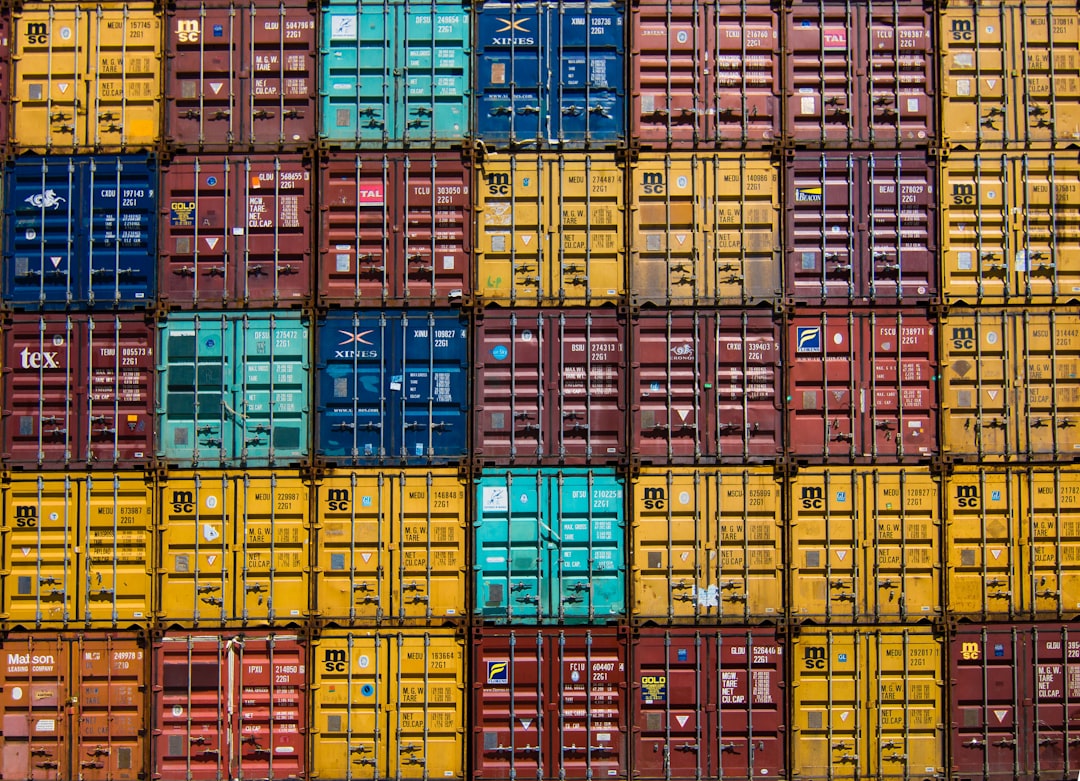

Container shipping rates spiked dramatically in late 2023/early 2024 due to attacks on vessels in the Red Sea, with Asia-US East Coast rates nearly tripling .

As of May 2024, Asia-US East Coast container rates were around $6,152 per forty-foot equivalent unit (FEU), while Asia-US West Coast rates were around $4,099 per FEU .

Overall Trends:

Freight rates across most modes declined in 2023 but have been trending upward in 2024 .

Analysts expect freight rates to continue rising in the second half of 2024 as capacity tightens and volumes increase .

Factors driving rate increases include rising fuel costs, driver shortages, equipment constraints, and geopolitical disruptions .

LTL (less-than-truckload) rates are expected to see 3-5% increases in 2024

Economic Factors

The truckload market is expected to be in an inflationary cycle by Q2 2024, with spot rates likely overtaking contract rates.

This shift may create pressure for shippers later in the quarter as carriers seek to increase profitability after a difficult 2023.

Geopolitical Impacts

Ongoing geopolitical issues, such as the Red Sea crisis, may continue to affect global shipping routes and rates.

This could indirectly impact domestic trucking as shippers adjust their supply chain strategies.

Prepare for these Trends

Plan shipments well in advance (48-72 hours recommended) to secure capacity at reasonable rates.

Be flexible with pick-up and drop-off windows to increase chances of finding available trucks.

Stay informed about regional factors affecting trucking, such as harvest seasons or construction projects.

Consider integrating technology solutions to improve efficiency and tracking capabilities.

Keep sustainability goals in mind when selecting carriers or planning shipments.

"Partnering with us allows for flexibility, efficiency, and scalability to meet your needs!"

Additional Advantages of Preferred Partnership